Recent stock market volatility and a litany of geopolitical uncertainty in recent years from the pandemic, inflation, the war in Ukraine, etc. may further confirm for some individuals that the risk of investing in the stock market is one too hazardous for them to undertake.

Additionally, people have school, jobs, and their social life to worry about and don’t have time to research the best stocks to invest in and keep up with a quickly changing landscape. So perhaps it’s better to avoid the risk, let your money sit in a savings account, and have the peace of mind that you won’t lose any of it, right?

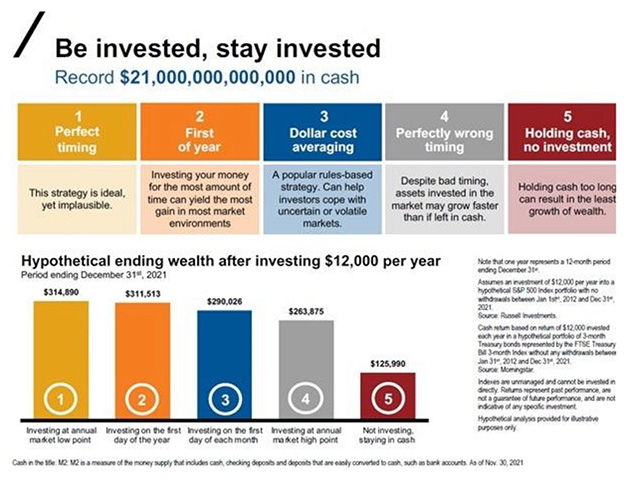

Although the market can be quite volatile short-term, it’s a challenge for even the worst investors to underperform against a proverbial mattress full of cash over the long run. What I’m saying is, give enough shots to a blind darts player and even he’ll hit more times than the man that never shoots. For a better visualization of this, let’s look at the following graphic from Russell Investments representing the various financial results of an individual who received and saved $12,000 annually between 2012 and 2021.

There will always be world events and short-term risks that tempt us to keep our money out of the market, yet in the long-term investing in the market has almost inevitably been a more surefire bet than staying in cash. While a win in the U.S. market isn’t absolutely guaranteed, it has ended the fiscal year positive 74% of the time over the last 95 years. Those are incredible odds!

If the stock market’s history of success isn’t enough for you to invest, then maybe take into consideration what’s happening to your money as you hold it in cash. Holding your funds in cash seems like the safest option, not even a bank robber poses a threat to the face value of your funds as they sit stowed away in a savings account.

However, inflation can have a serious impact on the purchasing power of your savings. Overtime that savings account doesn’t look as attractive as it once did, even if the number you see is the exact same as it once was. As time goes on the purchasing power of that savings account dwindles more and more and over the long-term can have a serious impact on its purchasing power.

The higher the inflation the bigger the impact. Let’s say you have $100,000 that you place in a savings account. The national average interest rate for a savings account is about 0.06% so you therefore finish the year with $100,060 in your account. Taking our current inflation rate of about 8%, what your $100,000 could afford at the beginning of the year will essentially only have the same purchasing power as $92,000 by the end of the year. Now picture your account shrinking every year by the net amount of inflation less your savings rate which would be approximately 7.64% for this year and it’s clear why investing your money is the wiser decision.

Always Account for Risk

It’s important for every investor to realize that the stock market does still pose risk, even perhaps over an extended period. A broad portfolio may provide solid returns on average, but life is unpredictable, and it is not possible to predict the timing of a market downturn. That’s why it’s crucial for investors to align their portfolio with their timeframe, liquidity needs, and overall risk tolerance.